Let me answer in very simple and easy language the most common questions individual Indian freelancers may have regarding GST

Let me answer some of the common questions that Individual Indian freelancers may have related to GST.

The most crucial point to note here is – I am not a GST or Tax consultant. I am trying to answer them from my personal experience being a freelancer in India. Moreover, the answers are from a general perspective. For a specific case to case basis, it is better to consult a GST consultant expert in your area.

So without much ado, let’s begin

Do Individual freelancers need to pay GST?

The answer is YES. However, only those individual freelancers who have an annual turnover of more than ₹20Lakhs need to register and pay the GST. One more point to consider is, the export of services is exempt from GST. So we have three scenarios to consider.

- Total revenue of under 20L – No need to register for GST and so there is no point of paying GST.

- Total revenue of above 20L but only works for foreign clients – One may need to register for GST, but because the income is from offshore clients, you may not need to pay the GST. However, you may need to submit the letter of undertaking or LUT for the same. Consult a GST expert on the matter to submit the LUT.

- Total revenue of above 20L but works for both offshore and Indian clients – One may need to register for GST. For income for foreign clients, you may have to submit the letter of undertaking. As you have a GST number, you will have to charge GST for Indian clients.

What is the GST rate for individual freelancers?

Indian freelancers working for other Indian clients and have a total turnover of more than 20L requires to pay 18 percent Goods and Services Tax.

The GST Rate for individual freelancers is 18%.

However, the client is the one who pays GST. In an invoice or a bill, the freelancer will add the GST amount. Once the client makes the payment, the freelancer will pay the GST amount. Depending on the states of the client and freelancer, the applicability of IGST or (CGST+SGST) may vary.

However, for offshore clients, one can use the letter of undertaking or LUT.

What is IGST, CGST, SGST?

- IGST or Integrated Goods and Services Tax is the GST rate applicable when the freelancer and the client are in two different states.

- CGST or Central Goods and Services Tax is the component of GST that the central government collects for sales of goods and services within a state.

- SGST or State Goods and Services Tax is the component of GST that the state government collects for sales of goods and services within a state.

The GST Rate for individual freelancers is 18%.

If your client is in the same state, you charge 9% CGST and 9% as SGST. However, if your client is a different state, then you 18% as IGST.

Is GST applicable to Individuals?

Yes GST rate applies to individuals who have annual revenue of more than 20L.

Is GST applicable for turnover below 20 lakhs?

An individual freelancer with a total turnover of fewer than 20 lakhs doesn’t require to register for GST on a mandatory basis.

What is GSTIN?

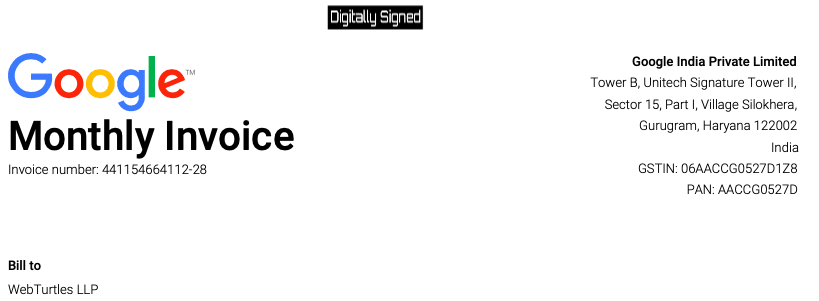

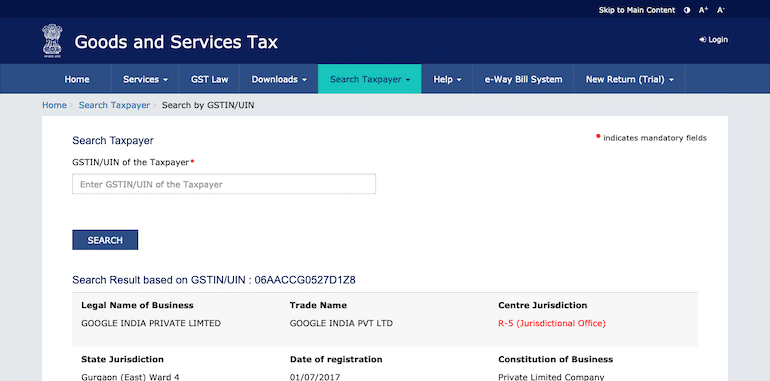

GSTIN stands for GST Identification Number or commonly known as the GST number. The GSTIN is a 15-digit PAN-based unique identification number allotted to every GST registered business. Here is an Invoice for Google Ads where you can see the GSTIN.

One can use the official GST website to verify the GSTIN.

Is the GST number mandatory for freelancers?

No, it is not mandatory to have a GST number for individual freelancers. However, if your annual turnover exceeds the threshold limit, it becomes mandatory.

Who pays GST tax?

The export of services is exempted from GST. So for freelancers, the GST is applicable only for local clients.

Each invoice a freelancer raises, they have to add the GST of 18% in the final bill amount either in the form of IGST or CGST+SGST.

So, it is the client who pays the GST. Freelancer only collects the GST from clients and deposit it on their behalf.

Can I issue an invoice without GST?

Yes, you can. GST is mandatory for those who have an annual turnover of more than ₹20Lakhs. So any freelancer who doesn’t have much turnover can still issue an invoice without the GST number or GSTIN.

What is GST applied to?

GST is applied to the bill amount. So let’s say you provided a quote to a client for ₹10,000, excluding GST. So in the final bill, when applying GST of 18% to ₹10,000, the amount the client needs to pay is ₹11,800.

If you quote as ₹10,000, including GST, one has to do the same calculation backward. The actual amount pre-GST is ₹8,475 and a GST of ₹1,525

Is GST mandatory for PayPal?

No, it is not mandatory to have a GST number in PayPal. Normally PayPal is used for offshore payments. As the export of services is exempted from GST along with a requirement of the total turnover of above ₹20L. So PayPal has not made it mandatory to have the GSTIN or GST Number.

However, one needs to use a Purpose Code For using PayPal.

Is GST mandatory for Upwork?

No, it is not mandatory to have a GST number in Upwork. Indian freelancers use Upwork for foreign clients. As the export of services is exempted from GST along with a requirement of the total turnover of above ₹20L. So Upwork has not made it mandatory to have the GSTIN or GST Number.

What is the turnover limit for the GST audit?

GST Audit is completely different from GST Registration. The turnover limit for GST registration is 20Lakhs, whereas, for GST Audit, it is 2 Crores. However, it can vary from sector to sector along with goods or services rendered, and so it is better to consult a GST expert for the exact requirement for your business.

Is GST applicable to rent?

Yes, GST is applicable to rent. However, GST is only applicable for renting of commercial property and not on renting of residential property.

The GST rate for rent is @18%.

What is ITC or input tax credit?

Input Tax Credit or ITC means claiming the credit of the GST paid on your behalf for the purchase of Goods or Services in the chain of doing the business.

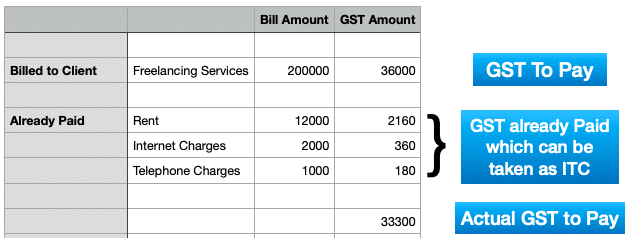

So let us take an example to understand ITC for a freelancer’s point of view.

Let’s assume a monthly turnover from Indian clients only of ₹2Lakh. So one has to pay the GST at the rate of 18%, which is ₹36,000.

However, the freelancer may have paid rent as well as internet and telephone charges to work for clients. So he can take the GST paid on those bills as the input tax credit or ITC.

Is ITC available on rent paid?

Yes, rent is not exempted from ITC, and so a freelancer can take an input tax credit for the GST paid on the rent for a commercial property.

Can I have more than one GST number?

Yes, one can have multiple GST Numbers. Though GST Number is tied to a PAN number, one can still have multiple GST Numbers from a single PAN. Ideally, a business will need a separate GST Number for each of the branches, divisions, warehouses, offices.