Purpose Code is a code issued by Reserve Bank of India (RBI) to classify the nature of foreign currency transaction.

Purpose code is a code issued by Reserve Bank of India (RBI) to classify each transaction with the nature of foreign currency transactions. In other words, the Purpose code helps regulators in identifying the exact nature of a cross-border transaction. So, it is mandatory for any cross-border payments in India. There are two categories of purpose codes.

- Receipt Purposes – For payments received by Indians in foreign currency.

- Payment Purposes – For Payments sent by Indians in foreign currency.

In each of the above categories, there are various purposes of a foreign currency transaction known as purpose code.

Bank and other payment processors have to report each of the transactions with a purpose code. Any Payment Processing Option even if they send a payment in Indian currency to the bank account, they require a purpose code for the transaction.

Table of Content

The Codes as Defined by RBI

Here is an official PDF from RBI with all the purpose codes that you can refer in the Tabular form below for convenience:

| Group | Code | Description |

|---|---|---|

| 00 Capital Account | P0001 | Repatriation of Indian investment abroad in equity capital (shares) |

| P0002 | Repatriation of Indian investment abroad in debt securities. | |

| P0003 | Repatriation of Indian investment abroad in branches | |

| P0004 | Repatriation of Indian investment abroad in subsidiaries and associates | |

| P0005 | Repatriation of Indian investment abroad in real estate | |

| P0006 | Foreign direct investment in India in equity | |

| P0007 | Foreign direct investment in India in debt securities | |

| P0008 | Foreign direct investment in India in real estate | |

| P0009 | Foreign portfolio investment in India in equity shares | |

| P0010 | Foreign portfolio investment in India in debt securities including debt funds | |

| P0011 | Repayment of loans extended to Non- Residents | |

| P0012 | Loans from Non-Residents to India | |

| P000H | Receipts of Non-Resident deposits (FCNRB/NRERA etc.) ADs should report these even if funds are not “swapped” into Rupees. | |

| P0015 | Loans & overdrafts taken by ADs on their account. (Any amount of loan credited to the NOSTRO account which may not be swapped into Rupees should also be reported) | |

| P0016 | Purchase of a foreign currency against another currency | |

| P0017 | Sale of intangible assets like patents, copyrights, trademarks, etc. by Indian companies | |

| P0018 | Other capital receipts not included elsewhere | |

| 01 Exports of Goods | P0101 | Value of export bills negotiated/purchased/discounted etc. (covered under GR/PP/SOFTEX/EC copy of shipping bills etc.) |

| P0102 | The realization of export bills (in respect of goods) sent on collection (full invoice value) | |

| P0103 | Advance receipts against export contracts (export of goods only) | |

| P0104 | Receipts against the export of goods not covered by the GR/PP/SOFTEX/EC copy of shipping bill etc. | |

| P0105 | Export bills (in respect of goods) sent on collection. | |

| P0106 | Conversion of overdue export bills from NPD to collection mode | |

| P0107 | The realization of NPD export bills (full value of the bill to be reported) | |

| 02 Transportation | P0201 | Receipts of surplus freight/passenger fare by Indian shipping companies operating abroad |

| P0202 | Purchases, on account of operating expenses of Foreign shipping companies operating in India | |

| P0205 | Purchases on account of operational leasing (with crew) – Shipping companies | |

| P0207 | Receipts of surplus freight/passenger fare by Indian Airlines companies operating abroad. | |

| P0208 | Receipt on account of operating expenses of Foreign Airlines companies operating in India | |

| P0211 | Purchases on account of operational leasing (with crew) -Airlines companies | |

| P0213 | Receipts on account of other transportation services (stevedoring, demurrage, port handling charges, etc.) | |

| 03 Travel | P0301 | Purchases towards travel (Includes purchases of foreign TCs, currency: notes, etc. over the counter, by hotels, hospitals, Emporiums, Educational institutions, etc. as well as the amount received by TT/SWIFT transfers or debit |

| P0308 | FC surrendered by returning Indian tourists. | |

| 04 Communication Service | P0401 | Postal services |

| P0402 | Courier services | |

| P0403 | Telecommunication services | |

| P0404 | Satellite services | |

| 05 Construction Service | P0501 | Receipts for the cost of construction of services projects in India |

| 06 Insurance Service | P0601 | Receipts of life insurance premium |

| P0602 | Receipts of freight insurance – relating to import & export of goods | |

| P0603 | Receipts on account of other general insurance premiums | |

| P0604 | Receipts of Reinsurance premium | |

| P0605 | Receipts on account of Auxiliary services { commission on Insurance) | |

| P0606 | Receipts on account of the settlement of claims | |

| 07 Financial Services | P0701 | Financial intermediation except investment banking – Bank charges, collection charges, LC charges, cancellation of forwarding contracts, commission on financial! Leasing etc. |

| P0702 | Investment banking – brokerage, underwriting commission, etc. | |

| P0703 | Auxiliary services – charges on operation & regulatory fees, custodial services, depository services, etc. | |

| 08 Computer& Information Services | P0801 | Hardware consultancy |

| P0802 | Software implementation/consultancy (other than those covered in SOFTEX form) | |

| P0803 | Database, data processing charges | |

| P0804 | Repair and maintenance of computer and software | |

| P0805 | News agency services | |

| P0806 | Other information services- Subscription to newspapers, periodicals, etc. | |

| 09 Royalties & License Fees | P0901 | Franchises services – patents, copyrights, trademarks, industrial processes, franchises, etc. |

| P0902 | Receipts for use, through licensing arrangements, of produced originals or prototypes (such as manuscripts and films) | |

| 10 Other Business Services | P1001 | Merchanting Services – net receipts (from sale and purchase of goods without crossing the border). |

| P1002 | Trade-related services – Commission on exports/imports. | |

| P1003 | Operational leasing services (other than financial leasing and without operating crew) including charter hire | |

| P1004 | Legal services | |

| P1005 | Accounting, auditing, bookkeeping, and tax consulting services | |

| P1006 | Business and management consultancy and public relations services | |

| P1007 | Advertising, trade fair, market research, and public opinion polling services | |

| P1008 | Research & Development services | |

| P1009 | Architectural, engineering and other technical services | |

| P1010 | Agricultural, mining and on-site processing services – protection against insects & disease, increasing harvest yields, forestry services, mining services like analysis of ores, etc. | |

| P1011 | Inward remittance for maintenance of offices in India | |

| P1012 | Distribution services | |

| P1013 | Environmental services | |

| P1019 | Other services not included elsewhere | |

| 11 Personal, Cultural & Recreational services | P1101 | Audio-visual and related services -services and associated fees related to the production of motion pictures, rentals, fees received by actors, directors, producers, and fees for distribution rights. |

| P1102 | Personal, cultural services such as those related to museums, libraries, archives, and sporting activities and fees for correspondence courses of Indian Universities/Institutes | |

| 12 Government, not included elsewhere (G.n.i.e.) | P1201 | Maintenance of foreign embassies in India |

| P1203 | Maintenance of international institutions such as offices of IMF mission, World Bank, UNICEF, etc. In India | |

| 13 Transfers | P1301 | Inward remittance from Indian nonresidents towards family maintenance and savings |

| P1302 | Personal gifts and donations | |

| P1303 | Donations to religious and charitable institutions in India | |

| P1304 | Grants and donations to governments and charitable institutions established by the governments | |

| P1306 | Receipts / Refund of taxes | |

| 14 Income | P1401 | Compensation of employees |

| P1403 | Inward remittance towards interest on loans extended to non-residents (ST/MT/LT loans) | |

| P1404 | Inward remittance of interest on debt securities – debentures/bonds/FRNsetc, | |

| P1405 | Inward remittance towards interest receipts of ADs on their own account (on investments.) | |

| P1406 | Repatriation of profits to India | |

| P1407 | Receipt of dividends by Indians | |

| 15 Others | P1501 | Refunds/rebates on account of imports |

| P1502 | Reversal of wrong entries, refunds of the amount remitted for non-imports | |

| P1503 | Remittances (receipts) by residents under the international bidding process. | |

| P1590 | Receipts below $10,000 (say Rs 5,00,000) |

Similarly, for payment of money in foreign currency, a similar purpose code exists in the official PDF. They start with an S.

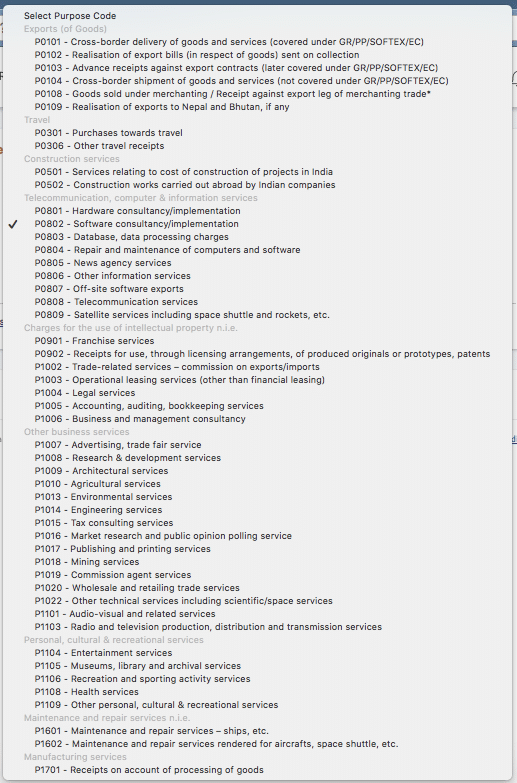

What Are Options for Purpose Code in PayPal?

One can’t use PayPal for payment within India. It is for receiving payments from abroad. So specifying a purpose code is a must for all transactions in PayPal. So PayPal has made it mandatory to provide a purpose code.

The default purpose code remains selected for all transactions until you need to specify a different Purpose code for a specific transaction.

PayPal offers the following Purpose code options for us to select.

Which Purpose Code to Choose?

Some of the options in the PayPal purpose code look overlapping. So I will help you make the right choice of purpose code for you.

The choice of purpose code will be based on where you get most of your PayPal payments. For me, software consulting is perfect because most of my PayPal payments come from my web development and consulting clients.

Yes, I do get some payments for the advertising revenue of my websites. But most of my payment is from my clients for web development and consulting. So my default purpose code is Software consulting under Information Technology or P0802

Software consulting will be the best-suited purpose code for all freelance developers.

Cross-border delivery of goods and services can also be valid for developers where a developer is delivering his or her services overseas. If you look at the category of the purpose code in bold, it is under Export of Goods (not an export of services), which I don’t see as the right category for a developer. So I avoid it as purpose code should be under the services and not under the export of goods.

If you are a writer where clients pay you for writing, the purpose code can be Other information services.

Remember, the choice of purpose code is to allow regulators to identify the nature of a transaction.

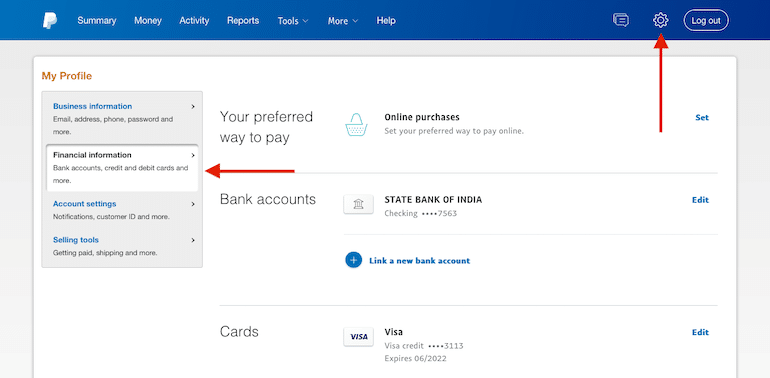

How to Change Purpose Code in PayPal?

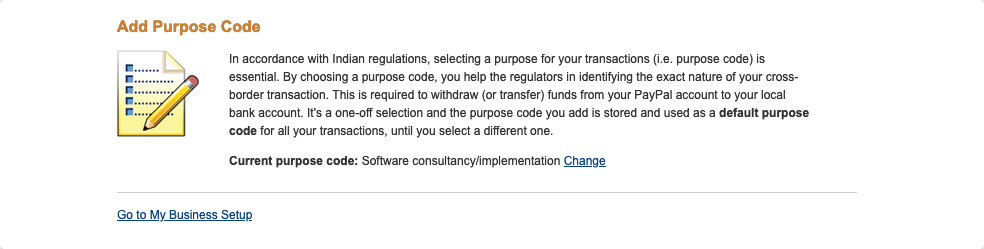

In PayPal business account, you can edit the Purpose code on the profile settings > Financial Information Page.

Scroll to the bottom, and you will find the option to edit the Purpose Code.

Now click on manage, and the page opens where you can view your selected default Purpose code in PayPal as well as have an option to change it.

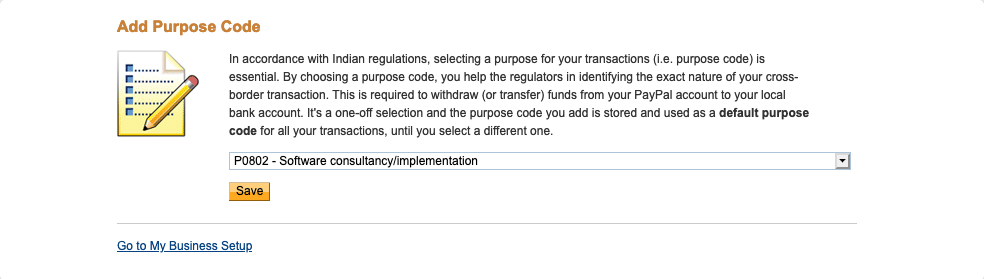

Click the Change link, and the option to edit the Purpose code opens up.

Select the right purpose you want to set as default for automatic payment and click on the Save button.

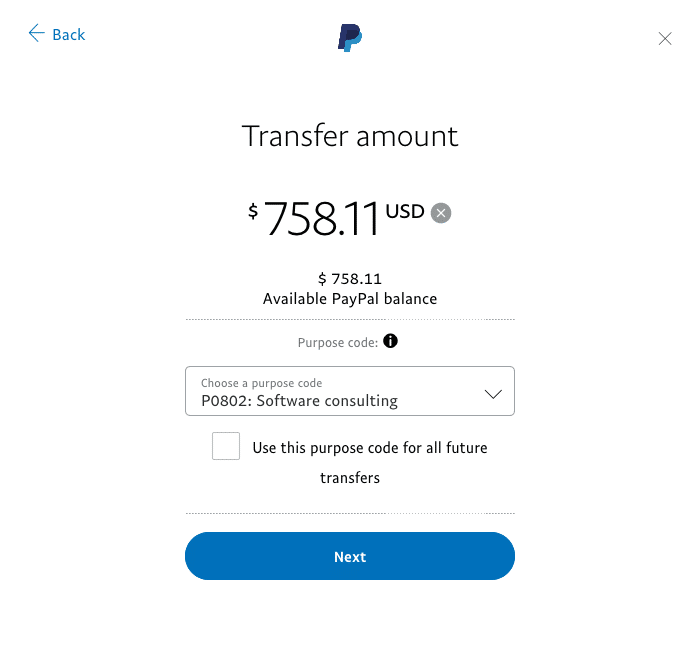

However, in PayPal professional account, there is no option to edit the default Purpose code in the profile section. At least I couldn’t find it. The only way to edit the default Purpose code is at the time of withdrawal.

It asks if you would like to change the purpose code for current withdrawal or making it a default for all future withdrawals as well.