10 savings bank account from the top Indian banks for freelancers based on the factors an Indian freelancer must consider before opening a saving account.

The best way to manage finances for a freelancer is to have a different bank account for the freelancing income or freelancing business. I prefer it that way because it helps me track my business and personal expenses, and help me budget my finances well. I even use different credit cards for different kinds of expenses to manage my finances.

So even if you have a savings bank account, it is better to open up a new savings account for the freelancing aspect of your business. You can do freelancing related income as well as expenses from the same account.

The list will help you make a good choice of a savings bank account.

BTW Here are 9 Ways To Receive Payments From Foreign Clients for Indian Freelancers.

6 Types of Savings Account offered by major Indian Banks:

- General Savings Account

- Savings Account for Senior Citizens

- Zero Balance Savings Account

- Savings Account for Salaried

- Minor’s Savings Account

- Savings Account for Women

The next step is to decide which bank savings account is ideal for you. There are certain factors that I have listed below in order to help you make an informed decision about opening a new savings account.

1. Charges/Fees

This is an important factor to inspect closely upon selecting a bank.

First-hand charges that bank applies are on cash withdrawal, extra checkbook, ATM card charges, debit or credit card annual fees, mobile notifications, other bank ATM withdrawal charges, and so on.

There are certain banks that don’t charge account holders for services mentioned above but also not limited to the above-mentioned ones.

You must get relevant details online about pertaining charges in the first place and then decide which one to go with.

2. Minimum Balance Requirements

Private sector banks like Axis and ICICI have norms to maintain a minimum balance in a savings account. It can anything between Rs.10,000 to Rs. 50,000 depending upon the account type.

This is not the case with the public sector banks. Bank of Baroda or State bank of India or even a Punjab national bank savings account requires only Rs.1,000 to keep an account active and help a freelancer when starting out.

There are certain banks that allow you to maintain Zero Balance in your salary account converted into a savings account.

3. Facilities Offered

Today almost every bank offers all kinds of required facilities to the savings account holders.

This includes debit cum credit card, ATM cards, net banking, mobile banking, online fund transfer, bill payments, online mobile & DTH recharge, EMI payments, online shopping using debit, credit or ATM cards and much more. Private sector banks are good at the fastest online services.

But if physical branches are taken into account no one can beat SBI.

As a matter of fact, banks offering swift online services must be preferred because you would not want to waste time lingering in bank queues for long hours or miss an EMI due to insufficient balance as there was a bank holiday.

4. Better Customer Services

As far as customer service as a metric is inclined to select a bank – the private sector wins the trophy. They indeed have an exceptional track record in serving their customers and should be the choice of the bank account for a freelancer.

On the contrary, they do charge their account holders heavily for prompt customer services, but then being a freelancer time is valuable for you compared to those charges.

Though the above factors are important while selecting a bank for your savings account services your choice may vary depending upon your requirements, physical location, purpose and services offered by banks in your area.

Now it’s time to finally get down to the list. So, let’s start with it.

5. Interest Rate

Being a freelancer interest rate should not be the deciding factor to open a savings account. Generally, banks offer a minimum of 3.5% yearly interest on your savings account balance which is transferred into your account every 3 months (i.e. quarterly).

Certain banks offer a high rate of interest (around 5% to 6%) if you maintain a daily balance of more than Rs. 100,000.

If you want to maintain a large amount of balance in your savings account then you can select banks that offer a higher rate of interest.

But if you have planned to invest (in fix-deposits, mutual funds, SIPs, LIC, etc.) your earnings regularly and not keeping big cash in the savings account then it is advisable to go with banks that offer lowest interest rates on daily savings account balance.

Top Indian Banks Offering the Best Savings Account for a Freelancer

1. State Bank of India (SBI)

- The State Bank of India offers Basic Savings Bank Account with zero balance facility.

- There are no additional charges applicable to this account.

- This savings account has no maximum limit on the deposits that you make.

- KYC is mandatory at the time of opening the account.

- The applicant can open only one SBI basic savings account in his/her name.

- SBI’s basic savings account holders get RuPay debit card free with the account.

2. Bank of Baroda (BOB)

- Bank of Baroda offers Super Savings Account for metro & urban residents.

- Free passbook and statements of account.

- 100 free withdrawals in one year.

- Unlimited Free checkbook facility.

- Free SMS mobile alerts.

- Minimum balance required if you are in a metro/urban location.

- Free Debit Card with 3 to 5 free monthly ATM transactions.

- You can even transfer your account to other branches free of cost.

- An a/c holder can withdraw up to Rs. 50000/day at any outstation branches.

3. HDFC Bank

- HDFC Bank offers a Regular Savings Account.

- Exclusive debit cards as per account holder requirements.

- Get Rewards Debit Card or a Rupay Premium Debit Card with your Regular Savings Account.

- Cross-product benefits like AMC waiver for the first year for your first Demat Account

- Enjoy net, phone & mobile banking facilities to check account balance, pay bills, stop cheque payments & more.

- Facility to set instructions for utility bill payments over the phone using BillPay

- Personalized cheques with the name printed on each cheque leaf for additional security.

4. ICICI Bank

- ICICI offers the applicant to open a Regular Savings Account.

- You must not have a savings account with the same name.

- ICICI gives you 15 leaves checkbook free per year. Additional ones are chargeable.

- The account holder gets a free debit card.

- Internet banking and cash deposits are free of any type of charge.

- Pay bills from the comfort of your home or office with Bill Pay facility.

- You get free monthly account statements in your email.

- An account holder can also have a printed passbook for account statements.

5. Axis Bank

- Axis bank offers Basic Savings Account to its customers.

- This savings account is a part of Pradhan Mantri Jan Dhan Yojana (PMJDY) Scheme

- The applicant doesn’t need to maintain a minimum balance in this account.

- It includes benefits like free cash deposits, access to 2500+ branches and 12000+ ATMs across India.

- The account holder also gets non-chargeable internet and mobile banking services.

- The joint account holder also gets free RuPay Debit Cards.

- Axis Bank also provides you with e-statements, SMS alerts, and a passbook facility.

- This account gives you a 3.5% interest on the daily balance, quarterly.

- Enjoy the zero balance facility.

6. Kotak Mahindra Bank

- Kotak Mahindra Bank offers an 811 Digital Savings Account.

- You can open a Kotak 811 account using a smartphone.

- No branch visit for account opening. Do it from home.

- 6% interest per annum on the daily savings account balance.

- No minimum balance issue. It’s a Zero balance account.

- 811 virtual debit card to shop online at Kotak Mall (KayMall).

- Free online money transfer facility.

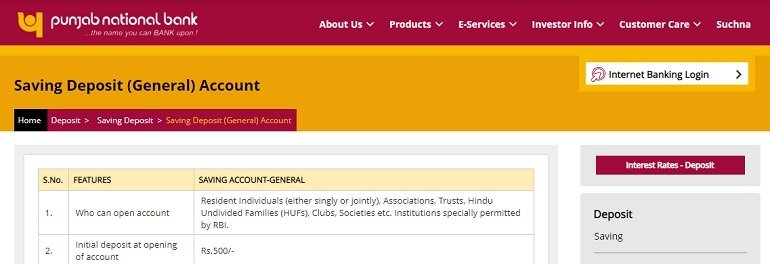

7. Punjab National Bank (PNB)

- PNB offers a Saving Deposit (General) Account.

- The applicant can open a savings account with a deposit as little as Rs.500 only.

- PNB savings account gives you 50 free debit transactions to do in 3 months.

- Maximum Rs.50,000/- per day 3rd party cash payments

- Free fund transfer within PNB accounts & free internet banking facility.

- Savings account portability within P.N.B branches without changing the account number

- Fast remittance of funds through NEFT/RTGS

- Safe Deposit Lockers available online also.

- The online account opening facility also provided.

8. Bank of India (BOI)

- Bank of India offers Saving Bank Ordinary Account.

- Like PNB you can open a savings account with Rs. 500 only here too.

- Internet Banking facility available.

- Unlimited ATM transactions at BOI ATMs across India.

- Online Income Tax return filing facility.

- Personalized checkbook on account holder request.

- Free utility bills payment through the Epay facility.

- Mediclaim policy of NICL available at a low premium for BOI customers

9. Central Bank of India (CBI)

- Central Bank of India offers CENT Bachat Khata.

- It can be opened with a minimum deposit of just Rs.50. Minimum balance of Rs.50/-

- Additionally, the bank charges no service charges for not maintaining the minimum balance.

- Account holder gets free 50 withdrawals per year free of cost.

- One checkbook per year free of charge.

- Simplified KYC procedure for the applicant.

10. Yes Bank

- YES, Bank offers first of its kind all-new Customizable Savings Account.

- The rate of interest is 6%* per annum on the daily account balance.

- The applicant can select the services they want upon account opening.

- Card with Tap&Pay services enabled with domestic and international limits.

- The minimum balance requirement for this account is Rs. 10,000.

- If a/c holder wants to get rid of maintaining minimum balance then he/she has to either do an FD of Rs.50000 or a recurring deposit of Rs.5000/month.

Final Take on Top Savings Bank Account for a Freelancer

When I was in Kolkata, I had all my accounts in HDFC Bank only but when I moved to Surat, the services of HDFC Bank aren’t as good as it was in Kolkata. So I have moved all my bank accounts into SBI Bank now.

One of the main reasons I moved to SBI bank is that I get wire transfers from my clients as well as from Adsense and SBI has better Forex rates.

Choose the bank that works for you and you don’t have to waste too much time banking.

As per my experience being a freelancer for a decade dealing with foreign clients, I would suggest going with SBI or BOB in public sector banks for a savings account. In the private sector banks, you can go with ICICI, Axis, HDFC or YES bank.

The other aspect to consider is, your specific requirements, physical branch location and other services being offered by the bank in your home branch.