What is the Product Tax Code or PTC? How Amazon India map product tax code to GST HSN code to calculate the correct GST rates?

What is the Product Tax Code or PTC for Amazon India?

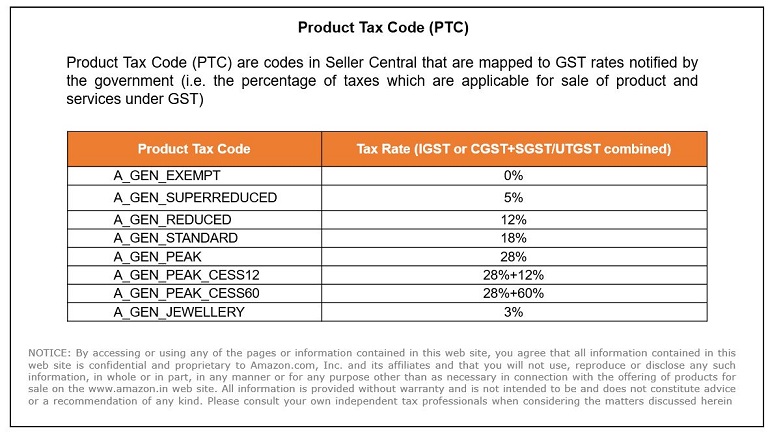

The product tax code (PTC) is Amazon India’s defined codes for each type and kind of product. They are used to match a product or service with correct GST rates notified by the government. PTC helps assess the tax amount payable to the GST authority in India. The marketplace calculates the tax amount based on the code supplied by the seller.

A seller can set PTC on two levels:

- Account-level – At the time of seller registration, the system will ask for PTC, which becomes the default tax code. It is mandatory for tax calculation services. Moreover, without it, the account registration won’t proceed further.

- ASIN listing level – This is optional since the default account level, PTC, is already present. However, a seller can always edit PTC for individual products using the edit product link on the inventory page.

How Amazon India Calculate Tax?

The product tax code is an attribute. While listing products, a seller needs to provide the exact Amazon India product tax code that will map the applicable GST rates for the product.

Further, the tax calculation system uses PTC to calculate tax on the products or services listed on the marketplace. The main reason for every seller to update PTC at Amazon India seller account.

Amazon India Product Tax Code and GST Percentage Chart

How to Add, Edit, or Update the Default Set Product Tax Code?

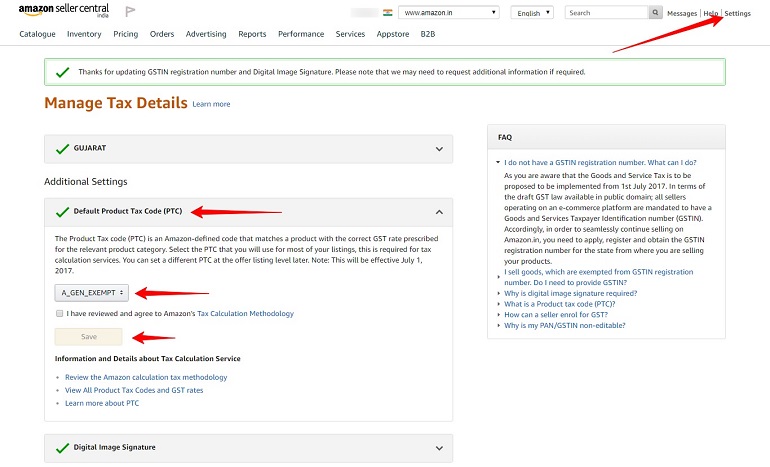

As I said above, the product tax code is mandatory during the seller registration process. To add, edit, view, or update the default product tax code, follow the steps below:

On the seller-central page, click tax settings under the main settings in the top right corner.

Now you are on the manage tax details page. Further, click the default product tax code (PTC). Select the correct PTC for your products from the drop-down items. Click save to submit the tax code.

How to Add, Edit, or Update Product Tax Code for Each Product?

A seller can add, edit, or update product tax codes on the ASINs level too. The above one is on the account level. Now seller can add, edit or update PTC for listings both individually and in bulk. Let me show you how.

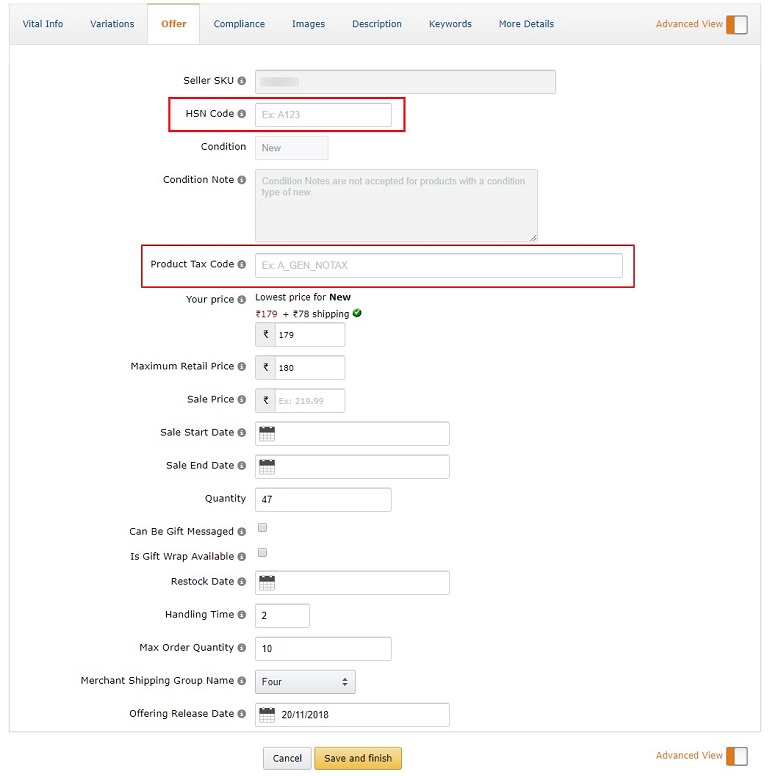

1. Edit Each Individual Products (ASINs)

Click manage inventory under the main inventory tab, click the edit button next to the listing. Now click the offer tab. Use the advanced view toggle button if you don’t see the offer tab. Locate the product tax code box, select relevant PTC from the list. Click save and finish.

Now that you are on the edit product page, update your product HSN code too.

HSN (Harmonised System of Nomenclature) is an internationally accepted product coding system. In India, HSN codes are used under Goods and Services Tax (GST) law, for the classification of products/goods.

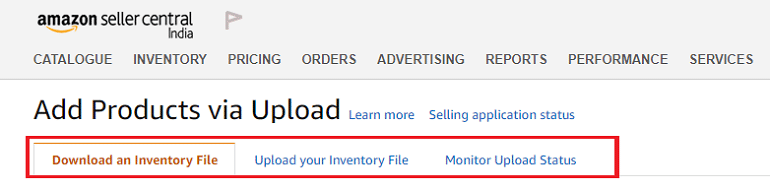

2. When Using Bulk Edit using Excel Template

Download the excel template for bulk update of product tax codes. Refer Add Products on Amazon India Via Excel Template, where I have explained detail steps on how to download and upload bulk upload excel sheets.

Download the product category excel file. Copy the product SKU codes from the inventory page. Open the excel file and locate the PTC column. Enter the correct product tax codes for all SKUs. In the update/delete column, select partial updates. Save the excel file and upload it.

Product tax codes help the marketplace to assess the tax amount on a product sold. Hence, it is essential to update them. If you don’t know your product tax code, then contact Amazon India seller support. You can also consult your CA for the same. It is ultimately for the seller’s benefit.